The main objective of REITs is to create regular income and capital appreciation. It invests across real estate facilities such as industrial parks, offices, warehouses, hospitality centres, malls, healthcare centres, etc. REITs are real estate investments that help diversify an investment portfolio and also hedge against inflation. Hence investors looking for investments other than stocks and bonds can consider investing in real estate investment trusts.

Just like any other instrument, you should look at the quality of the underlying asset of the Reit. The Brookfield real estate investment trust IPO is open for subscription for investors. After the successful listing of two Reits—Embassy Office Parks and Mindspace Business Parks—this is the third Reit to be listed on Indian bourses. Both REITs and mutual funds investments give you tax exemptions.

- An SPV is a company or a limited liability partnership in which the REIT holds or proposes to hold at least a 50% equity stake.

- Also known as mREITs, it is mostly involved with lending money to proprietors and extending mortgage facilities.

- Covid like situations may even worsen the things by decreasing the yields even further, as in many companies a majority of the employees are working from home and God knows when things will settle down!

- Brookfield India REIT came in second with 7.30% absolute returns.

- Overall, the choice between investing in REITs or Mutual funds completely depends on an individual’s investment goals, risk tolerance, and personal preferences.

A https://1investing.in/ is a trust which pools money from investors and then invests the accumulated amount into the real estate. A REIT invests the money into real estate projects mostly in medium term gestation projects. Investors are liable to get dividends as returns by investing in REIT. It is a nice finance tool to take a bet on property markets and multiply their wealth. The structure is like the mutual funds however underlying asset here is physical real estate.

Minimum number of subscribers

She brings more than four years of financial markets expertise to the team. Thus, it is advisable to run thorough market research and analyse if REITs align with your investment objectives. Similar to equity stocks, REITs are also launched through an Initial Public Offering and follow on public offer . Once the initial offer is closed, and the allotment is done, REITs trade on the stock exchange. With SEBIs recent regulations, the minimum investment has considerably reduced to INR 15,000.

It is a kind of security that offers all investors, no matter how big or small, a source of consistent income, portfolio diversity, and long-term capital growth. REITs are publicly traded on the stock exchange as any other security. A REIT functions in a similar way to mutual funds and offers you an easy way to invest in real estate.

Rent or Buy Property

This allows the realty companies to focus more on executing realty projects rather than owning the realty assets. No need to issue cheques by investors while subscribing to IPO. Lastly, REIT returns are expected to be less volatile compared to equity returns due to the long term nature of most commercial lease contracts.

Global Self Storage: There Are Better Opportunities On The Market … – Seeking Alpha

Global Self Storage: There Are Better Opportunities On The Market ….

Posted: Tue, 11 Apr 2023 06:31:24 GMT [source]

Hence investors who can afford to invest this amount can go ahead and invest. 80% of the total investment should be placed in income-generating assets. Only 20% of the total investment can be made in under-construction assets. Investors can be on the lookout for REIT IPOs and invest in these when they are launched. This requires thorough research and understanding of all the risk factors of REITs. Since Indian REIT market is still evolving and there are only few REIT options available, investors have to wait for the next IPO to be launched.

MFs vs REITs

In the last 4Y, the company had grown its revenue by 6.9% CAGR to 1750 Cr. The NAV has moved up from 326.1 at the time of IPO to 370.3 as of Nov 2022. Units can also be easily bought and sold without any hassles. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND.

Investors can diversify their portfolio by parking their funds in both mortgage REITs and equity REITs. Hence, both rental income and interest income are the sources of income for this particular kind of REIT. Take a moment to download our company snapshot and browse through the attributes of our 42.4 msf portfolio.

WHY INVEST IN REITs?

You are therefore advised to obtain your own business.com: expert business advice, tips, and resources legal, accounting, tax or other professional advice or facilities before taking or considering an investment or financial decision. Real estate investment trusts pay dividends to investors as per their earnings. Publicly traded REITs come with the risk of losing value in case interest rates rise. Also, there is a risk of losing money on non-traded / non-listed REITs which can be difficult to research.

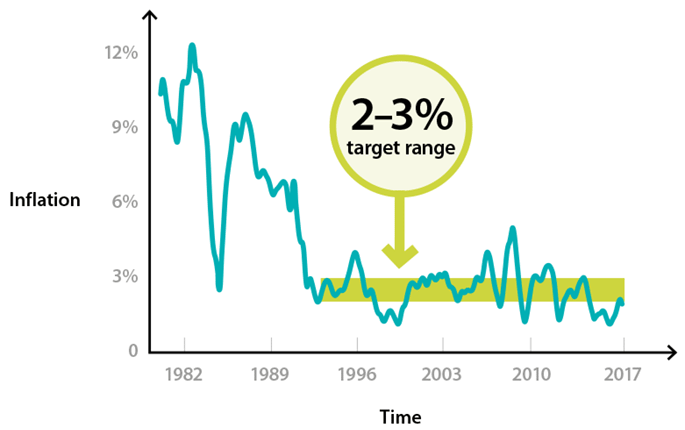

Also, they analyse the company’s role in facilitating capital appreciation in the long run. As per research, REITs enables investors to hedge the effects of inflation in the long run. For instance, by staying invested for a term of 5 years, investors can protect their funds from inflationary effects more effectively as compared to stock options. When the value of REIT appreciates, investors tend to earn substantial returns.

As per a report, listed Real Estate Investment Trust in India saw a 6.85% year-on-year growth in the total leasable area. From only 87.6 million square feet in Sep’21 to 93.6 msf in Sept’22. Healthcare REITs – These REITs invest primarily in real estate for hospitals, health clinics, medical establishments, etc. Here click on the “Privacy & Security” options listed on the left hand side of the page.

Additionally, they are required to oversee the activity of the manager and ensure the timely distribution of dividends. They should opt for ETFs and mutual fund options that invest in REITs. Since these funds come with professional assistance; investors would be able to manage them more proficiently. As REIT are mostly traded on stock exchanges, it becomes very easy to buy and sell them, hence adding the benefit of quick liquidity.

This Website is provided to you on an “as is” and “where-is” basis, without any warranty. To help you for your money needs you can avail the facility of MoneyForLife Planner (‘MoneyForLife Planner/ Planner’). MoneyForLife Planner facility is powered by Aditya Birla Money Limited, a subsidiary of ABCL. The Planner provides an indicative view about the generic investment opportunities available in the manner indicated by you. The results provided by the Planner are generic in nature and do not necessarily reflect the actual investment profile that you may hold and it is not necessary for you to act on it.

The minimum investment for a REIT investment was INR 50,000 prior to July 30th, 2021. The minimum investment amount is now between INR 10,000 and INR 15,000 following SEBI’s notification on July 30th, 2021. The minimum investment is now in the range of INR 10,000 to INR 15,000 because to SEBI’s recent relaxation in investment threshold. There are currently only 3 REITs available for investment in India – Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust.

Clicking “I Agree” to “Terms & Conditions”, shall be considered as your electronic acceptance of this Agreement under Information Technology Act 2000. While SEBI first conceptualized the idea of REIT in 2008, the first REIT was only launched in 2019. Investors who want to add real estate to their investment portfolio can now do so without even owning the property through REITs. The value of the real estate tends to increase during times of inflation as property prices and rent goes up, thus giving a better return to the REIT investor.

REITs generate a gentle income stream for investors but offer little in the way of capital appreciation. Hybrid REITs allow investors to diversify their portfolios by investing in both equity and mortgage REITs. Here, both rent and interest are the primary sources of income for investors. Mindspace REIT if you are conservative and taking a debt investors’ point of view.With a well-diversified portfolio & highest tax-free distribution, this suits HNIs as a good long-term bet. However, the mark-to-market headroom for FY23 is on the lower side when compared to its peers. A well-managed property in a prime location will have the highest occupancy rate.

Commenti recenti